Produit en promo

Produits populaires aujourd'hui

-

Bâche, Signalétique, Tous les produits

Bâche agence immobilière

Bâche pour agence immobilière – Banderole à vendre à louer

Renouvelez vos supports de communication pour la vente ou la location de biens grâce à des bâches “à vendre”, “à louer” ultra design, claires et efficaces ! Nos bâches agence immobilière de 440g sont légères et résistantes aux intempéries, ce qui en font des panneaux immobiliers souples qui dureront dans le temps et pourront être réutilisés ! Plus pratique qu’un panneau rigide, vous pourrez transporter facilement vos bâches enroulables à vendre, vendu ou à louer : que vous soyez à pieds, dans les transports en commun ou en deux roues, vous pourrez emmener vos panneaux à vendre partout avec vous. Plusieurs formats disponibles.

SKU: n/a -

-

-

-

-

-

-

-

-

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produits

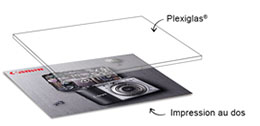

PLAQUES PROFESSIONNELLES IMPRIMÉES

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produits

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produitsPLAQUES PROFESSIONNELLES IMPRIMÉES

Le PMMA est traité anti UV ce qui augmente la durée de vie du produit. L’utilisation du PMMA coulé permet une meilleure résistance à la coupe et à la casse.

Votre visuel sera imprimé en vitrophanie au verso.

SKU: n/a -

-

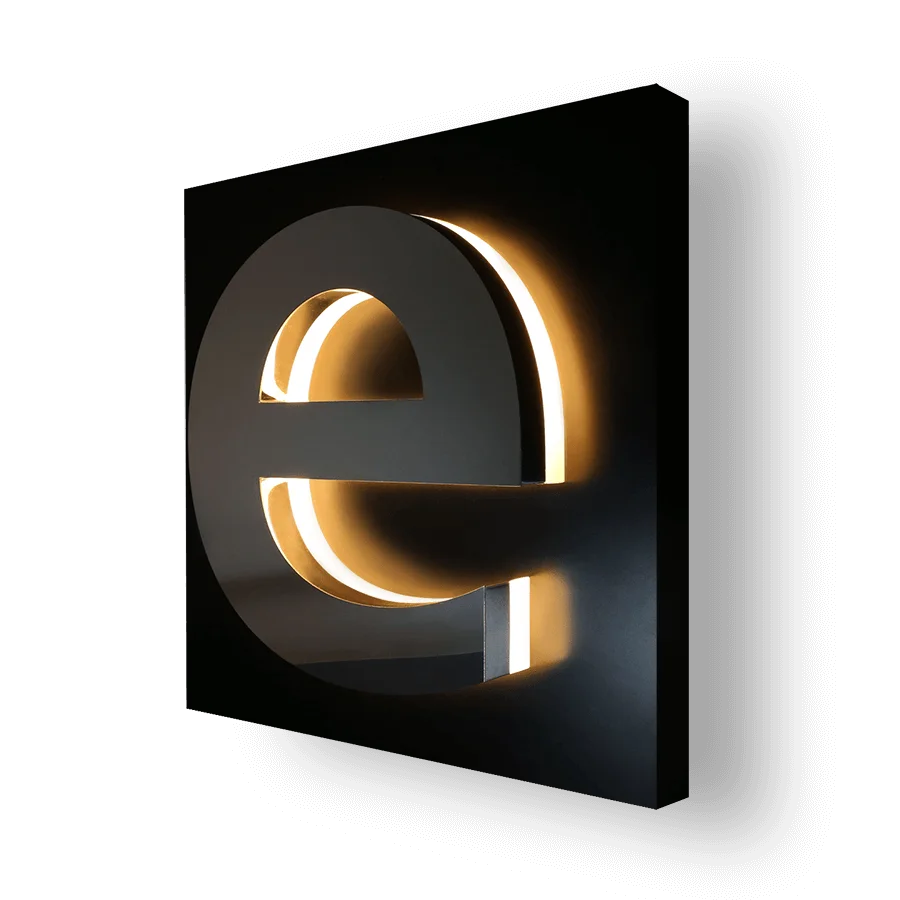

Eclairage : LED homogène, puissant et sans ombre.

Eclairage : LED homogène, puissant et sans ombre.

Eclairage : LED homogène, puissant et sans ombre.

Eclairage : LED homogène, puissant et sans ombre.