Produit en promo

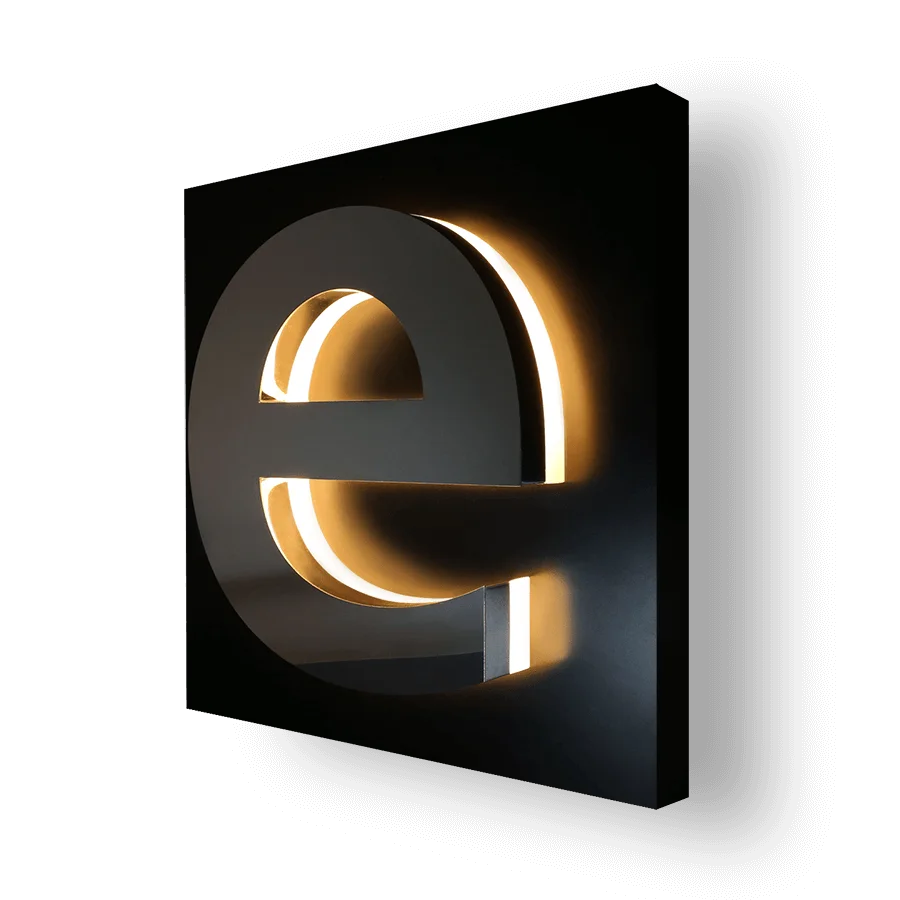

Logo Lumineuse finition Miroir

À partir de 990,00 DHRoll’up Economique

690,00 DHProduits populaires aujourd'hui

-

Bâche, Signalétique, Tous les produits

Bâche agence immobilière

Bâche pour agence immobilière – Banderole à vendre à louer

Renouvelez vos supports de communication pour la vente ou la location de biens grâce à des bâches “à vendre”, “à louer” ultra design, claires et efficaces ! Nos bâches agence immobilière de 440g sont légères et résistantes aux intempéries, ce qui en font des panneaux immobiliers souples qui dureront dans le temps et pourront être réutilisés ! Plus pratique qu’un panneau rigide, vous pourrez transporter facilement vos bâches enroulables à vendre, vendu ou à louer : que vous soyez à pieds, dans les transports en commun ou en deux roues, vous pourrez emmener vos panneaux à vendre partout avec vous. Plusieurs formats disponibles.

SKU: n/a -

-

-

-

-

-

-

-

Grand format, Habillage de Voiture, Tous les Produits

Habillage de Voiture (Grand Van / Fourgon)

-11%

Grand format, Habillage de Voiture, Tous les Produits

Grand format, Habillage de Voiture, Tous les ProduitsHabillage de Voiture (Grand Van / Fourgon)

- Citadine / Petite voiture

- Toyota Yaris, Peugeot 208, Renault Clio, Dacia Sandiro…

- Berline / Sedan

- Dacia Logan, Peugeot 301, Renault Megan…

- SUV / 4×4

- Nissan X-Trail, Toyota RAV4, Jeep Compass…

- Utilitaire / Van

- Ford Transit, Renault Kangoo, Dacia Dokker, Peugeot Pepper…

- Grand Van / Fourgon

- Ford Transit, Hyundai H350, Mercedes Sprinter …

SKU: n/a -

Grand format, Habillage de Voiture, Tous les Produits

Habillage de Voiture (Utilitaire / Van)

- Citadine / Petite voiture

- Toyota Yaris, Peugeot 208, Renault Clio, Dacia Sandiro…

- Berline / Sedan

- Dacia Logan, Peugeot 301, Renault Megan…

- SUV / 4×4

- Nissan X-Trail, Toyota RAV4, Jeep Compass…

- Utilitaire / Van

- Ford Transit, Renault Kangoo, Dacia Dokker, Peugeot Pepper…

- Grand Van / Fourgon

- Ford Transit, Hyundai H350, Mercedes Sprinter …

SKU: n/a -

-

Mug Personnalisé, Objet Pub, Tous les Produits

Mug Magique Personnalisé

Céramique de haute qualité, noire à l’extérieur et blanche à l’intérieur

Résistant au micro-ondes. Lavage à la main recommandé

Mug de 8cm de diamètre et de 9,5cm de haut. Contenance : 330ml

Mug noir à température ambiante laissant progressivement apparaître l’image sublimée au contact d’un liquide chaud. Une fois la température dissipée, ce mug recouvre sa couleur d’origine: le noir.

SKU: n/a -

-

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produits

PLAQUES PROFESSIONNELLES IMPRIMÉES

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produits

Administratif, Publicité / Commercial, Publicité / Commercial, Signalétique, Tous les produitsPLAQUES PROFESSIONNELLES IMPRIMÉES

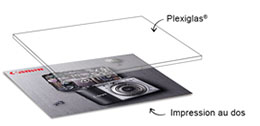

Le PMMA est traité anti UV ce qui augmente la durée de vie du produit. L’utilisation du PMMA coulé permet une meilleure résistance à la coupe et à la casse.

Votre visuel sera imprimé en vitrophanie au verso.

SKU: n/a