How Long Should you Keep Accounting Records? Records Retention Guidelines Leave a comment

His work has supported many companies on their path to growth, including helping them find investors, manage scaling and overcome hurdles. His experience and passion for business reach beyond accounting and he helps businesses focus on what the numbers mean organizationally, operationally and financially. We can take care of your accounting, bookkeeping, tax, and CFO needs so https://www.bookstime.com/ that you don’t have to worry about any of them. The general rule of thumb is that you should keep tax records for seven years and basis records until you sell your property. The IRS says that you must keep records for as long as the IRS may need them to administer any provision of the Internal Revenue Code. Proof of payment is a receipt that documents the transaction itself.

Publications

- If you send your tax return more than 4 years after the deadline, you’ll need to keep your records for 15 months after you send your tax return.

- Unfortunately, there isn’t a steadfast retention rule that applies to all kinds of records, meaning you need to categorize your files and create a document retention policy (DRP).

- You adopt a tax year by filing your first income tax return using that tax year.

- All electronic storage systems must provide a complete and accurate record of your data that is accessible to the IRS.

Also, hold on to any defined-benefit plan documents, estate-planning documents, life insurance policies, and an inventory of what’s inside your bank safe deposit box. While you’re focused on your tax papers, it’s good idea to organize all your financial documents, says Barbara Weltman, an attorney who runs Big Ideas for Small Business and how long to keep accounting records is the author of “J.K. Lasser’s 1001 Deductions & Tax Breaks 2022” (Wiley, 2021). To figure total monthly net sales, Henry reduces the total monthly receipts by the sales tax imposed on his customers and turned over to the state. He cannot take a deduction for sales tax turned over to the state because he only collected the tax.

Brokerage Statements

You must keep records to verify certain information about your business assets. You need records to figure the annual depreciation and the gain or loss when you sell the assets. Your home office will qualify as your principal place of business for deducting expenses for its use if you meet the following requirements. The following are brief explanations of some expenses that are of interest to people starting a business. There are many other expenses that you may be able to deduct.

Q2. Can a company keep its records manually in a physical form?

If your electronic storage system meets the requirements mentioned earlier, you will be in compliance. If not, you may be subject to penalties for non-compliance, unless you continue to maintain your original hard copy books and records in a manner that allows you and the IRS to determine your correct tax. Journals can include physical records or digital documents (e.g., spreadsheets or information stored in accounting software).

However, if you elect to use the simplified method, use the Simplified Method Worksheet in the Instructions for Schedule C or Pub. To get the payee’s SSN or EIN, use Form W-9, Request for Taxpayer Identification Number and Certification. A partnership is the relationship existing between two or more persons who join to carry on a trade or business.

To avoid becoming your client’s filing cabinet, remind clients of their obligation to keep their own records, and let them know that the firm’s workpapers are not a substitute for the client’s records. When your records are no longer needed for tax purposes, do not discard them until you check to see if you have to keep them longer for other purposes. For example, your insurance company or creditors may require you to keep them longer than the IRS does. After you’ve reviewed federal rules and your state’s document retention schedules, you may still have records that you’re unsure about.

Stable Rock Services LLC (“Stable Rock Services”) has purchased the non-attest business of Rosenberg & Chesnov CPA’s LLP (“Rosenberg Chesnov CPAs”). Rosenberg Chesnov CPAs remains a licensed independent CPA firm that provides audit and other attest services to clients. These leased individuals will be under the direct control and supervision of Rosenberg Chesnov CPAs, which is solely responsible for the professional performance of audit and attest engagements. Good record-keeping matters just as much in an electronic world as in a paper world.

What Financial Documents Should You Keep Forever?

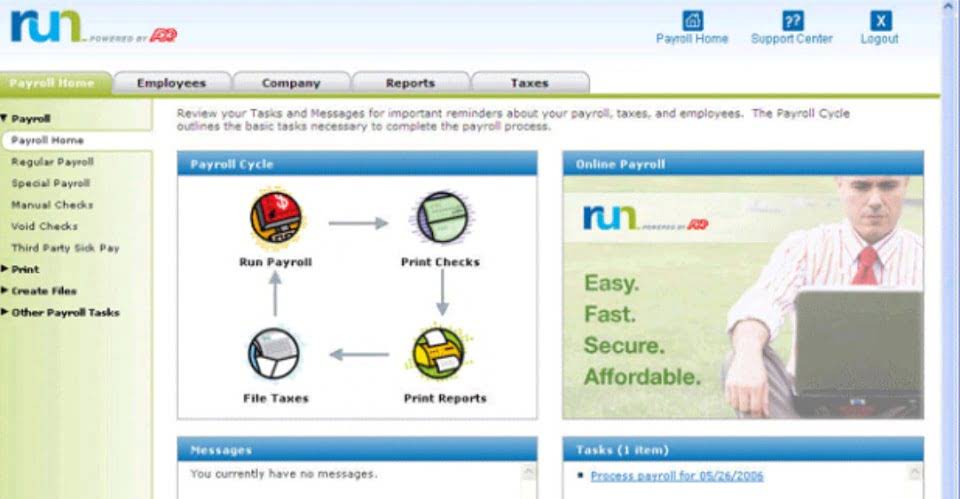

If you do not pay your taxes by the due date, you will have to pay a penalty for each month, or part of a month, that your taxes are not paid. You must file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, if you receive more than $10,000 in cash in one transaction or two or more related business transactions. It also includes certain monetary instruments such as cashier’s and traveler’s checks and money orders. You must use an electronic funds transfer (EFT) to make all federal tax deposits. Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). If you don’t want to use EFTPS, you can arrange for your tax professional, financial institution, payroll service, or other trusted third party to make electronic deposits on your behalf.